ExxonMobil announced today plans to acquire the Permian Basin’s largest oil producer—Pioneer Natural Resources—in an all-stock transaction valued at about $59.5 billion.

Upon closing the sum would be the highest ever paid for a US shale producer and the largest transaction in the oil and gas business since Royal Dutch Shell acquired BG Group in 2016 for $52 billion.

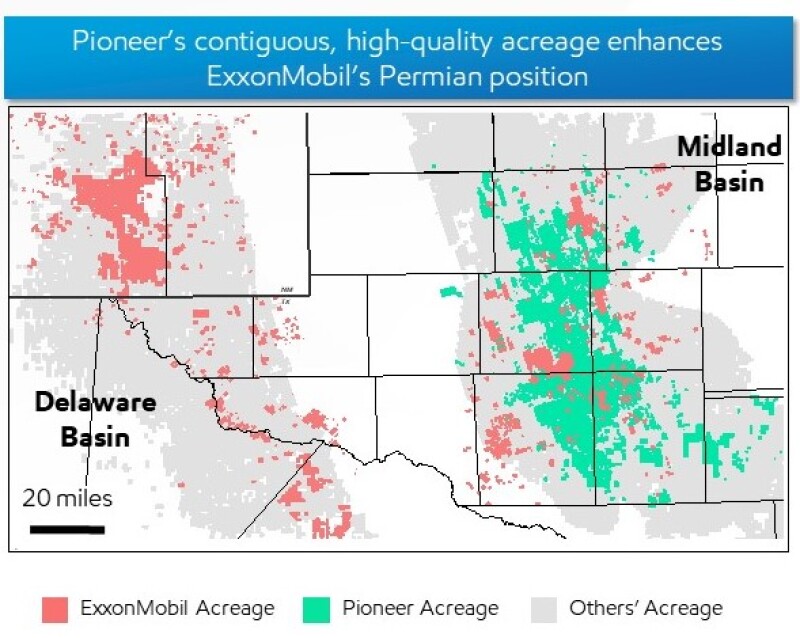

The deal will create a new Permian juggernaut by combining Pioneer’s 856,000 net acres in the Midland Basin with ExxonMobil’s 570,000 net acres. ExxonMobil estimates the combined Permian position holds some 16 billion BOE, which represents between 15 and 20 years of drilling inventory.

With a total of more than 1.4 million acres, ExxonMobil will join an exclusive club of massive landholders in the Permian which stretches across swaths of Texas and New Mexico. The other Permian heavyweights include ConocoPhillips with over 1 million acres, Chevron with 2.2 million acres, and Occidental Petroleum with 2.9 million acres.

On a pro forma basis, Houston-area-based ExxonMobil expects its Permian production will double to 1.3 million BOED—more than 75% of which is liquids.

By 2027, ExxonMobil said output could swell to 2 million BOED which would mean Permian production accounts for about 45% of the company’s total output.

The announcement added that Pioneer’s acreage is compatible with ExxonMobil’s strategy to drill up to 4-mile-long horizontal wells which it says reduces the overall number of wells it needs to develop the Permian.

Darren Woods, CEO of ExxonMobil, commented that Pioneer’s “Tier 1 acreage is highly contiguous, allowing for greater opportunities to deploy our technologies, delivering operating and capital efficiency as well as significantly increasing production.”

Pioneer operates around 7,000 producing wells and reported in August an average output of 369,000 B/D, or 711,000 BOED. Going forward, ExxonMobil expects lifting costs of Pioneer’s assets to be less than $35/bbl.

ExxonMobil also highlighted that the acquisition will expedite Pioneer's timeline for achieving net-zero emissions to align with its own objectives. The new goal for Pioneer's assets is to reach net-zero emissions by 2035, a 15-year advancement over the original 2050 target.

In terms of corporate and operational overlap, ExxonMobil is expecting synergies of $1 billion in the second year post-acquisition and an average of about $2 billion in savings annually over the next decade.

The deal places a value of $253 per share of Pioneer, a 9% premium to its prior 30-day weighted average.

Subject to regulatory and shareholder approvals, the transaction is slated to close early next year.