Canadian unconventional oil and gas producer Crescent Point announced this week that it has entered into an agreement to acquire Hammerhead Energy in a cash-and-stock deal valued at USD 1.5 billion including nearly $330.5 million in debt.

The transaction will make Crescent Point Canada’s seventh-largest oil and gas producer by volume, and the company has plans to boost production by 40% over the next year.

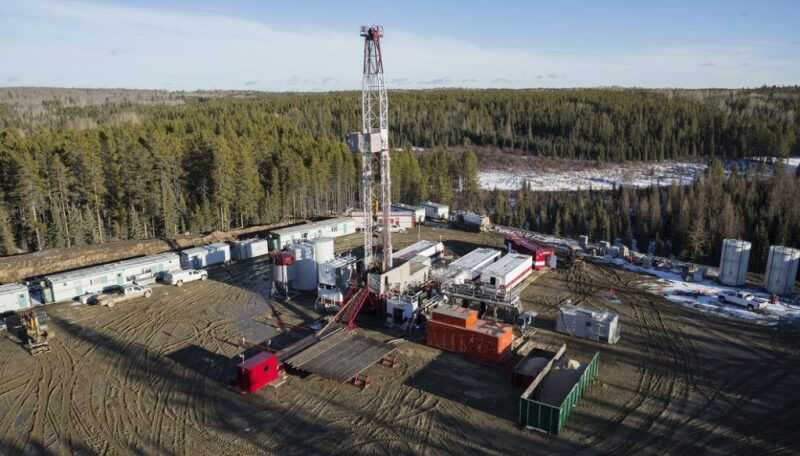

On a pro forma basis, Crescent Point is adding 105,000 net acres to bring its new land holdings total to 350,000 net acres in the oil window of Alberta’s Montney and Kaybob Duvernay shales.

The acquired lands hold an estimated 800 future drilling locations—primarily in the Montney—and also bring 56,000 BOE/D (50% liquids) of current production, which will raise Crescent Point’s output to 94,000 BOE/D (50% liquids).

Craig Bryksa, president and CEO of Crescent Point, described the deal as a "strategic consolidation" and said it hands the Calgary-based operator “a dominant position in both the Alberta Montney and Kaybob Duvernay plays, which are complemented by our low-decline, long-cycle assets in Saskatchewan.”

Crescent Point added that the combined company is expected to spend up to $1 billion next year in pursuit of boosting production beyond 200,000 BOE/D with 65% of the volume weighted toward oil and liquids.

Pending regulatory and shareholder approval, the acquisition is slated to close by December.

The move to buy out Hammerhead comes after Crescent Point agreed to spend $1.7 billion in March to acquire Spartan Delt Corp. and its 235,000 acres of Montney land.