Offshore staff

PERTH, Australia – Mexico’s regulator Comision Nacional de Hidrocarburos (CNH) has approved the development plan for the deepwater Trion oil project.

Operator Woodside Energy took FID on the project in late June, with subsequent support from partner Pemex.

Woodside's CEO said the CNH’s decision allows the company to fully progress into execution phase activities with its contractors.

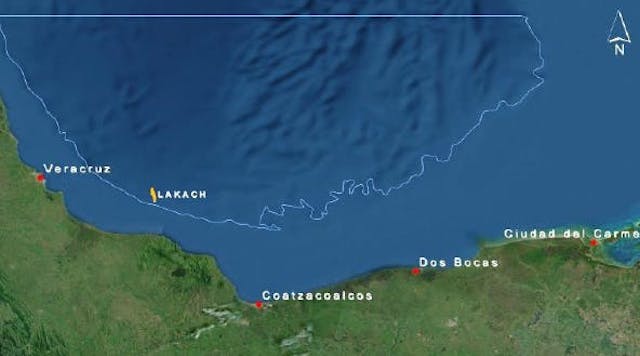

Trion is in 2,500 m water depth, 180 km offshore and 30 km south of the Mexico/US maritime border. Pemex discovered the field in 2012, with BHP Petroleum acquiring an interest in 2017 (subsequently taken on by Woodside in 2022 following its acquisition of BHP’s petroleum division).

Development will involve production from a 100,000-bbl/d capacity FPU, connected to a 950,000-bbl capacity FSO, with the crude shipped to international markets.

Plans call for drilling of nine producers, seven water injectors and two gas injectors during the initial phase and a total of 24 wells over the course of the project.

Gas not reinjected or used on the FPU will head to Mexico’s domestic natural gas pipeline network via a new subsea gas pipeline. Woodside estimates total capex of $7.2 billion.

The forecast total capex is US$7.2 billion ($4.8 billion Woodside share including capital carry of Pemex of about $460 million) including all 24 wells.

Contracts already awarded include EPC for the FPU to HD Hyundai Heavy Industries, Transocean for development drilling, SBM Offshore for the FPU and FSO installation, and OneSubsea UK for the subsea trees.

First oil is targeted for 2028. Woodside has a 60% operated interest in the development with Pemex Exploración y Producción holding the remaining 40%.

08.30.2023