Offshore staff

MEXICO CITY – Mexican state energy company Pemex and billionaire investor Carlos Slim’s team are discussing ways to revive development of the Lakach field development project in the deepwater Gulf of Mexico, according to a recent Reuters report.

That project, which would be Mexico’s first deepwater natural gas field development project, has been shelved twice before, two sources told Reuters.

The sources, both with direct knowledge of the matter, said executives of companies controlled by the Slim family met with Pemex on March 5th to discuss the Gulf of Mexico gas field. One of the sources said the parties had agreed to meet again.

The Lakach field has been hailed as a potential gateway to a new deepwater Mexican gas frontier. The sources said Pemex declared it a top priority to find a new partner after its last pulled out at the end of last year.

Pemex wants to develop the offshore field using a service contract where partners finance projects upfront, a mechanism used prior to the country’s energy sector opening, one of the sources told Reuters.

It was unclear whether Pemex and Slim’s companies plan to move forward with the project or whether others would be involved. The sources said Pemex had reached out to other companies as well.

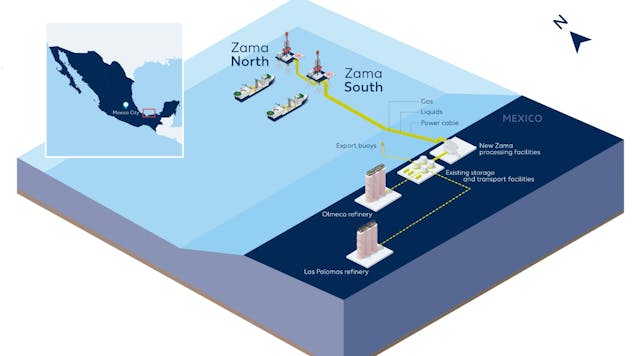

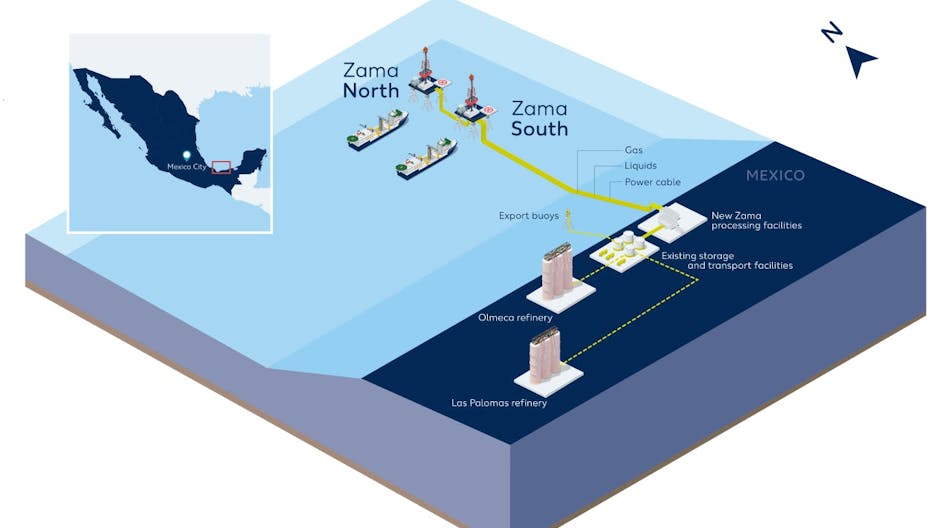

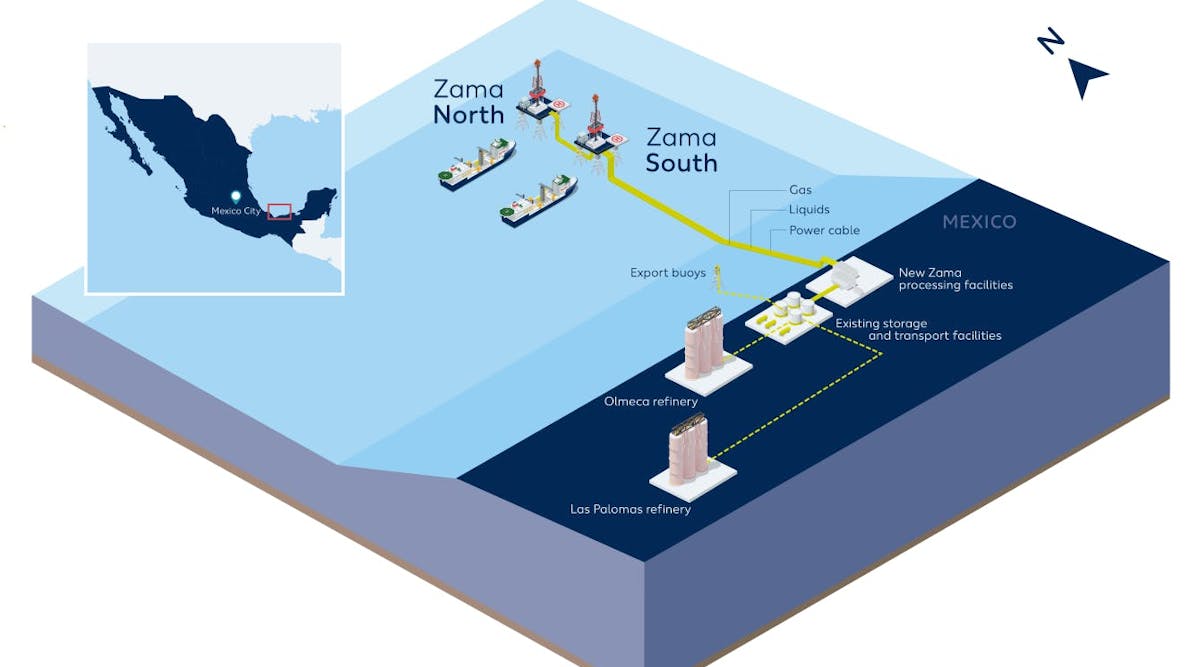

Slim, whose empire extends from telecommunications to mining to retail, has been increasing his participation in the energy sector since last year with stakes in shallow-water fields Zama, Ichalkil and Pokoch.

Slim owns stakes in various companies that could participate in the Lakach field, including construction companies FCC and IDEAL, which one source said attended the March 5th meeting.

However, both sources said Pemex and Slim would still likely need another company with deepwater expertise.

Reuters reported last November that Pemex and US liquefied natural gas company New Fortress Energy terminated a deal to develop the field because the parties could not come to an agreement on terms including pricing.

President Andres Manuel Lopez Obrador has said the field could be key for supplying much-needed gas to Mexico and bringing the country closer to energy self-sufficiency and had celebrated the deal.

When it was first announced, Pemex CEO Octavio Romero said that the partnership would enable Pemex to “fulfill Mexico’s security of supply targets.” The companies then said the field would likely yield production for 10 years or more.

Located some 90 kilometers (56 miles) from the Gulf port of Veracruz, it holds an estimated 900 billion cubic feet of gas. So far, Pemex has reportedly spent $1.4 billion on it. Plans to produce gas there were also shelved in 2016, after it was deemed too expensive.

Officials from the oil regulator and Pemex have also been at odds over how to develop the Lakach field. Reuters says that it has reviewed five internal assessments the regulator conducted between 2015 and 2022. In these, officials repeatedly raised questions over whether the project would be economically viable and technically feasible.

In one document, dated October 2022, officials at the regulator urged Pemex to submit additional information about “what programs will be implemented to mitigate risks and guarantee the success of the project.”

They noted a lack of deepwater gas expertise as well as missing studies of the field and its infrastructure; they also raised questions over already sunken costs and whether the project would ever turn a profit given low gas prices.

In another document, dated the same month, officials warned of uncertainty over the volume of gas the field actually holds, including conflicting assessments of proven reserves, and that the results of some trials deviated from what Pemex had projected.

03.11.2024