离岸人员

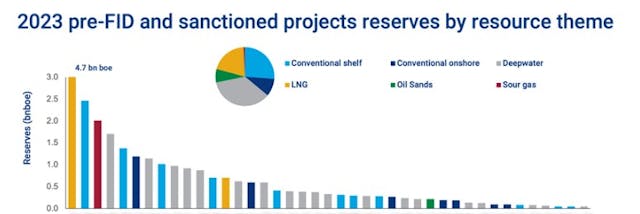

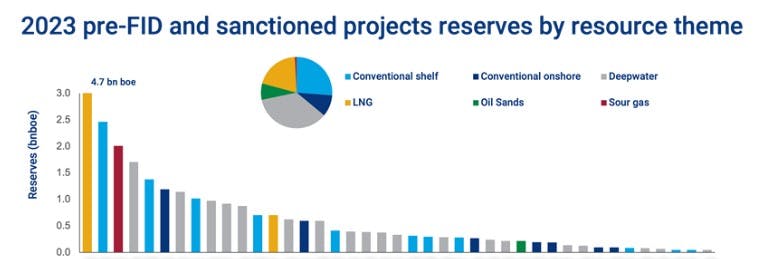

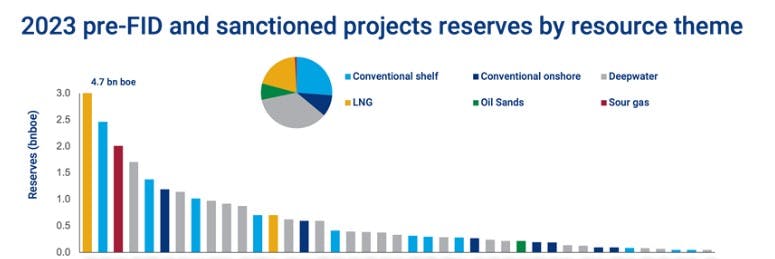

伦敦——Wood Mackenzie 预计今年上游石油和天然气最终投资决策 (FID) 将小幅增加,可能承诺开发 27 Bboe 资源的金额将高达 1,850 亿美元。

“实现石油和天然气项目的 FID 比以前更难,但由于 2022 年获得的制裁数量比预期少,我们相信今年的活动将略有增加,40 个最可行的项目中可能有 30 多个项目为了实现这一里程碑,”Wood Mackenzie 副总裁兼上游分析主管弗雷泽·麦凯 (Fraser McKay) 表示。 “大多数运营商将继续遵守纪律,碳减排仍将是许多 FID 项目的关键部分。”

国家石油公司可能会控制规模更大的新投资,这些投资针对已发现的资源,到 2023 年平均开发成本为 7 美元/桶油当量。

麦凯补充道:“国际石油公司将主要关注成本较高但回报较高的深水开发。” 他们将敏锐地意识到石油和天然气项目制裁在公共领域的表现以及对这些项目的审查。它们的相关排放量将受到影响。”

今年的项目平均需要 49 美元/桶原油才能实现 15% 的盈亏平衡内部收益率 (IRR)。该顾问表示,加权平均 IRR 为 19%,即 60 美元/桶,将是 2018 年以来的最低水平,今年项目的平均投资回收期为 9 年。

上游研究首席分析师格雷格·罗迪克表示,“短周期和小型海上项目在投资回收期和回报方面都将表现出色。” “就内部收益率而言,长寿命液化天然气项目会受到影响,但其有吸引力且稳定的未来现金流将具有战略重要性......

“优势深水石油和大陆架项目在排放方面表现将优于其他项目,但液化天然气、酸性天然气和一些陆上项目需要采取缓解措施。”

2023年13月4日