编者注:这篇专题文章首次发表于《Offshore》杂志 2023 年 11 月至 12 月号。单击此处查看完整问题。

作者:Mark J. Kaiser,路易斯安那州立大学

2016 年,作为深水地平线悲剧后对美国墨西哥湾作业进行更广泛审查的一部分,BSEE 开始要求运营商在完成永久堵塞任何油井、拆除任何平台或设施后 120 天内提交退役支出,以及任何场地的清理(NTL No. 2016-N03)。

2016年至2021年,美国墨西哥湾有500口水深超过400英尺(122 m)的井被永久废弃。在500口永久废弃井中,共有83口井废弃在401至1000英尺水深(几乎都是干树井),417口井废弃在>1000英尺水深(约一半是海底井)。

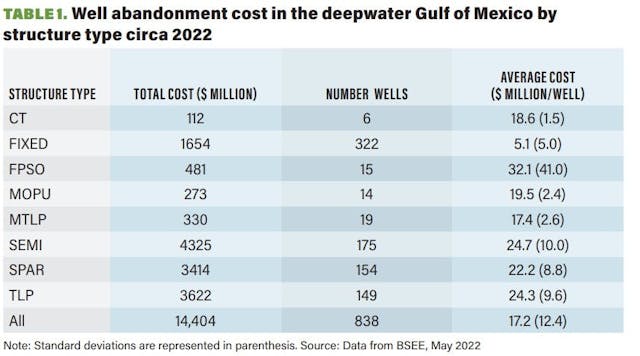

据报道,2022 年美国墨西哥湾深水区 838 口井的平均废弃成本为每口井 1720 万美元。平均干树废弃成本估计为 140 万美元/井。

这是由四部分组成的系列中的第二篇文章,其更大的目标是评估美国墨西哥湾深水区的 BSEE 成本估算(定义为水深大于 122 m(400 英尺)),跨越主要退役阶段并推断单位该地区的成本统计和成本函数。

成本估算方法

下面提供了对一些不同 BSEE 成本估算方法的分析。

统计与工作分解方法。BSEE 在深海中执行两种类型的成本估算:统计和工作分解,具体取决于操作类型和可用(收集的)数据的数量。

统计方法基于操作员提供的成本数据,并应用统计和经验技术,其中工作属性与操作员数据相关。

如果数据集相当大且多样化,并且在成本估算中应用最佳实践(标准)技术,则统计方法的结果将是有效的。如果数据集太小或多样化,或者资产属性或估计技术没有正确选择或应用,结果将不太有用和站不住脚。

在项目数据稀疏或无法获得的情况下(例如,浮动船退役),无法应用统计技术,并且需要其他成本估算方法。

工作分解方法是正式的假设成本估算,通过将操作分解为需要执行的多个任务,然后使用可用数据和适当的市场条件估算每个任务的时间和成本来执行。工作分解方法既耗时又注重细节,但在这种情况下它们是唯一可接受的方法。

工作分解方法可能会也可能不会与实际工作进行校准或比较,并且通常对结果缺乏高度的信心,但对于专门/独特的操作和/或稀疏数据集占主导地位的情况,它们被广泛接受。

概率方法与确定性方法。BSEE 方法未公开,但可以合理地推测,当报告概率成本估计时,有足够的运营商数据样本来导出(概率)成本统计数据,而在概率描述不可行的情况下应用确定性方法(例如,大数据传播和/或小样本)或可能(例如,专业化和多样化的操作)。

对于深水租赁的每口井、结构、管道段和场地清理,BSEE 报告每项资产的一个(确定性)成本估算或三个概率(P50、P70、P90)估算。

美国墨西哥湾深水区的所有油井和大约一半的固定平台(水深<200 m)均使用概率值报告,而大多数深水固定平台(> 200 m)和所有浮式平台成本估算均报告使用确定性成本估算。

一些井还报告确定性成本,但这些是小子样本或专门的井类型,而对于浮标、管道和场地清理和验证,仅报告确定性估计。

使用基于不附加分布值的操作员数据的单一统计数据(平均值或中值)被归类为确定性的,以及使用工作分解方法进行的所有估计。

井废弃成本

大约 2022 年,美国墨西哥湾深水区 838 口井的堵塞和废弃费用总计为 144 亿美元,即每口井约 1720 万美元(表 1)。

钻杆测试井和监测井等专用井由于其独特性而被排除在分析之外。其中约 100 口专用井的平均成本为 1,020 万美元(DSI,66 口井)或 1,790 万美元(DRL,16 口井)。大多数专业井都是湿井。

干树与湿树井

固定平台上的干树井的退役成本比湿树井便宜得多,因为可以通过位于平台上的钻机进入该井。对于湿井,需要 MODU 或修井船才能进入井眼,这大大增加了成本。

在实践中,水深和井深决定了所需船舶的类型,作业时的市场条件决定了船舶日费率,作业的复杂性和成功程度决定了持续时间。

对于浮式钻井平台来说,海底井在油井库存中占主导地位,但也存在一些浮式钻井平台的干树井。安装固定平台是为了钻探和维护干树井,但在其使用后期,它们也可能充当海底回接的主机。

因此,大多数深水结构都使用干树井和湿树井,但相对贡献不同,以干树井为主的固定平台和以湿树井为主的浮动平台。

TA 与 PA

所有必需的塞子均已就位但套管或立管未切割的井称为临时废弃井 (TA)。在所有条件相同的情况下,使 TA 井进入永久废弃 (PA) 状态的平均成本将低于使平均已完工井进入 PA 状态的平均成本,因为在前一种情况下,油井已经被堵塞,并且与此相关的成本不再需要执行活动。

对于干树井,在放置井塞后,套管和导线被切割和拉出,这可能发生在井作业期间或稍后在结构拆除之前。

如果操作员切割和拉动导线套管作为结构拆除活动的一部分,BSEE 要求操作员单独报告这些成本以及拆除的导线数量,以便 BSEE 可以(重新)将这些成本分配到油井废弃支出中,并更准确地表示废弃井的成本。

对于湿树井,TA 定义可以更宽松地使用,并指任何长时间关闭油井的操作,但与干树套管一样,在湿井永久废弃之前不会移除立管。

干枯的树井

2022 年固定平台上的 320 口井中,243 口是干树,77 口是湿树。干树的平均 PA 成本估计为 140 万美元/井,对于湿井,平均 PA 成本估计为 1690 万美元/井(表 1)。

与浅水区一样,BSEE 使用水深和测量深度来估算固定平台上干树井的 P50 PA 井成本。然而,与浅水区不同的是,深水区的固定平台要少得多,用于估算成本模型参数的数据也更少。

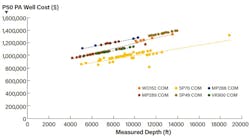

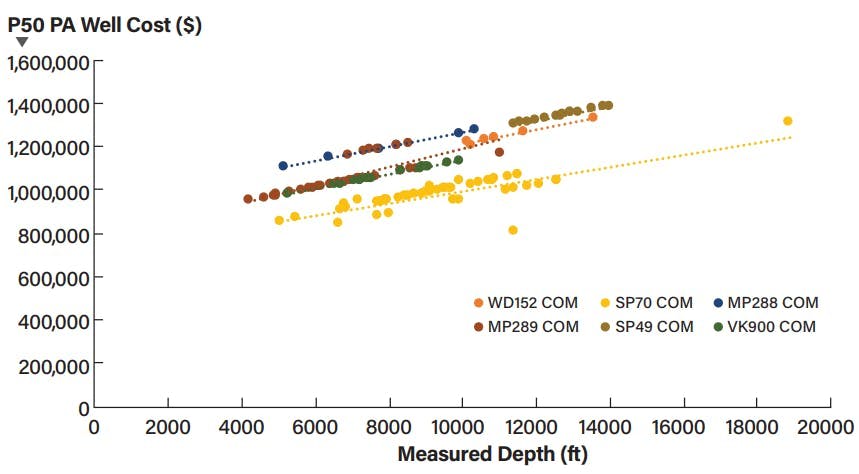

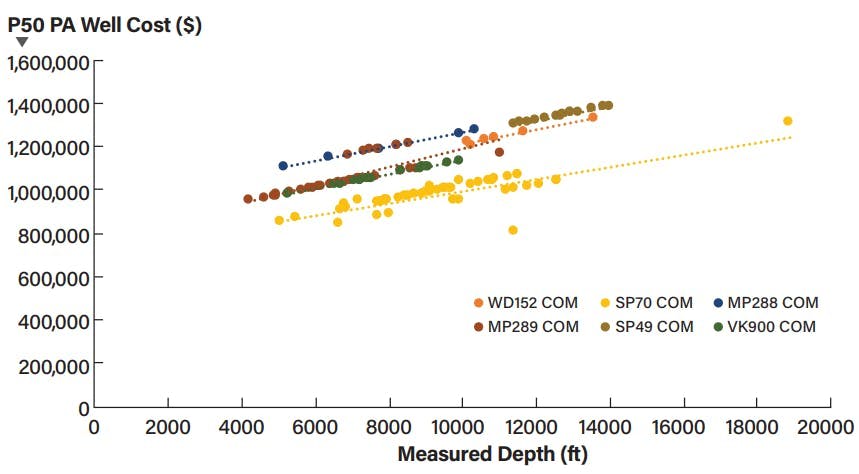

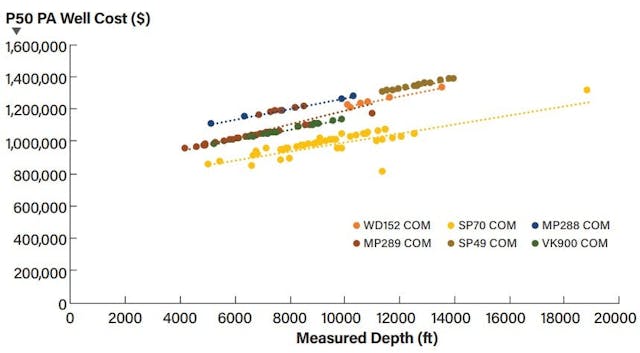

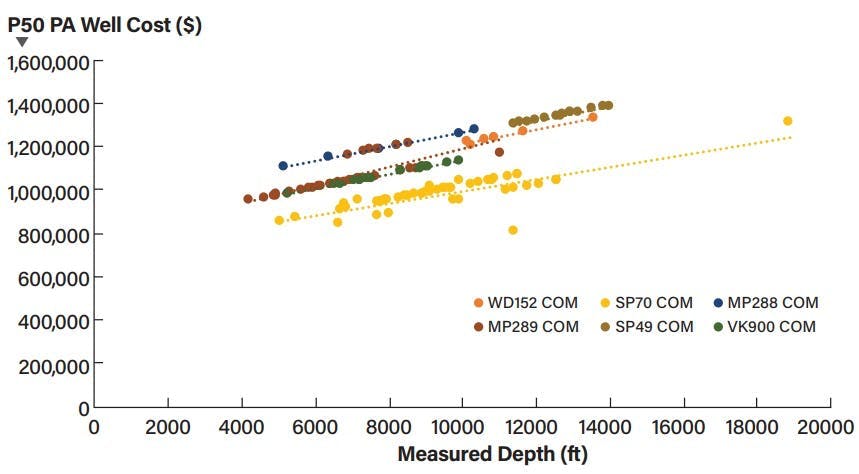

P50 深水 Main Pass (MP288、MP289)、South Pass (SP49、SP70)、West Delta (WD152) 和 Viosca Knoll (VK900) 固定平台上已完成的干树井的 PA 成本绘制为测量深度的函数图1。

已完成的干树井的 PA 成本曲线是向上倾斜的,基本上落在直线上,并且对于不同区域区块来说或多或少彼此平行。

在同一延伸区域中物理上彼此接近的块(例如 MP288、MP289)将具有相似(但不相同)的平均水深,因此线段重叠或靠近在一起,并且正如人们所期望的那样,成本曲线较大水深的井的成本曲线将高于较低水深的井的成本曲线(即,具有更高的成本)。

P50 PA 干树井成本函数通过延长面积使用广义形式计算:

P50 PA 干井成本 = α WD + β MD

其中 P50 PA 干井成本以美元为单位,水深 WD 以米为单位,测量深度 MD 以英尺为单位。

模型中使用的系数是从报告的数据中获得的,并且特定于每个延长区域。例如,对于 Main Pass,α = $6697/m,而对于 South Pass,α = $4857/m。在深水延伸区域,β 值在 28 美元/英尺到 42 美元/英尺之间变化。

潮湿的树井

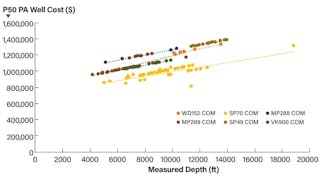

对于湿树井,BSEE P50 PA 井成本模型仅取决于测量深度,如密西西比峡谷 (MC) 13 个区块的测量深度,密西西比峡谷 (MC) 是墨西哥湾深水最多产的产区之一(图 2)。在图2中,水深范围从899 m(MC546)到2,360 m(MC612),所示的关系适用于已完井和暂时废弃的井。

P50 PA 湿井成本 = 1156 MD

其中 P50 PA 湿井成本以美元为单位报告,测量深度 MD 以英尺为单位描述。

结果表明,BSEE 在所有海底(湿)井的成本估算中应用了简单的线性函数,无论水深、(主体)浮标类型、区域块或井状态如何。

对于 P70 和 P90 PA 湿井成本曲线,模型系数分别为 1348 和 1633。P70 和 P90 概率成本估计中相对于 P50 乘数的乘数为 1.17 (=1348/1156) 和 1.41 (=1633/1156)。这些乘数可以被认为代表了意外事件、天气和其他意外事件的影响,这些事件使成本超出了其“预期”价值。

在海上成本估算中,工作意外费用通常被假设为项目总成本的 7% 至 10%,天气停机时间通常被假设为项目总成本的 10% 至 20%,这些费用大约以累积值表示的比率。

相关性和有效性

自NTL No. 2016-N03发布以来,向BSEE报告的油井废弃成本构成了一个庞大且多样化的样本,统计方法应足以建立美国墨西哥湾深水区油井废弃的可靠统计数据。

在 BSEE 井废弃成本模型中,对深水井最重要的描述是井是湿井(海底)还是干井,以及井眼的测量深度。对于固定平台干树井,平台水深是一个关键指标。湿井的 BSEE 成本模型中不使用水深,(主体)浮子类型、区域块或井状态也不发挥作用。

BSEE 在其深水(和浅水)井成本估算中应用了测量的深度关系,这在方法论意义上可能是合适的。但这种关系的广泛应用尚未被证明在海上 PA 井成本估算中有效或有意义。它当然使用起来很方便,但必须证明其相关性和有效性才能成为可接受的(且有效的)实践。

作者

马克·J·凯泽 (Mark J. Kaiser) 是路易斯安那州巴吞鲁日路易斯安那州立大学能源研究中心的教授。