编者注:这篇专题文章首次发表于《Offshore》杂志 2024 年 1 月至 2 月号。 单击此处查看完整问题。

作者:Mark J. Kaiser,路易斯安那州立大学

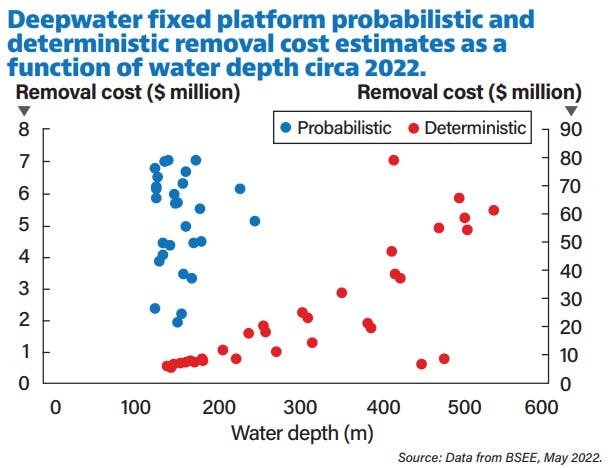

BSEE 估计美国墨西哥湾 122-250 米水深的平台退役成本为 480 万美元,大约是 61-122 m 水深范围内平台拆除成本的两倍。对于位于 250-500 m 水深的平台,成本估计为 10-8000 万美元。

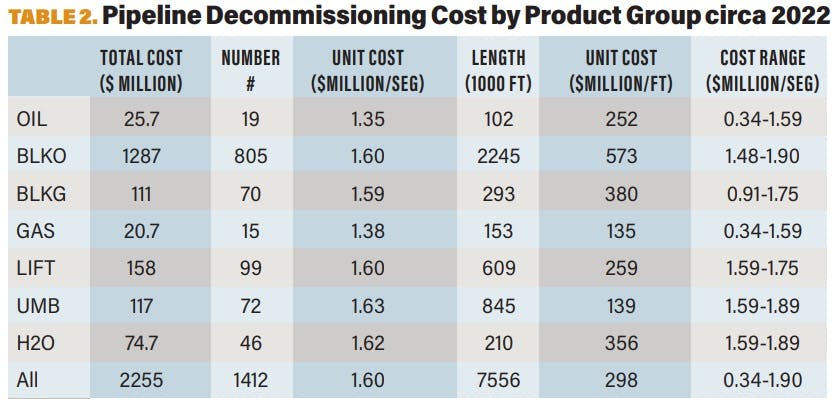

对于管道退役,散装石油、散装天然气、升力、脐带缆和水产品类别每个管道段的单位成本约为 160 万美元,石油和天然气产品类别每个段的单位成本为 135 万美元。在本系列文章的第 3 部分中,我们研究了美国墨西哥湾固定平台和深水管道的退役成本。

退役选项

浅水固定平台退役通常遵循完整的拆除程序,拆除平台并在造船厂报废甲板和导管架,或者拆除甲板并在指定的收帆位置收帆导管架。

在深水中,固定平台和合规塔是大型重型结构,所有退役方案都经过工程和经济可行性评估,包括就地倾倒。大多数漂浮物需要完全清除,但可能存在收礁的机会。

如果管道不会对航行、商业捕鱼作业构成危害或对其他用户造成不当干扰,则可以就地废弃。

就地废弃的管道需要冲洗、充满海水,并堵塞末端,将末端埋在泥线以下至少三英尺处,通常埋在沙袋或混凝土垫下。

根据作业时的水深、长度和市场条件,对脐带缆和出油管进行冲洗,并使用不同的船舶间距,与出口管道不同,脐带缆和出油管预计将完全从海底清除。

固定平台:概率成本估算

2016年至2021年,美国墨西哥湾水深超过400英尺(122 m)的8个固定平台、1个合规塔、2个浮标和多个管段退役。

对于“空心”深水(122-200 m水深)的固定平台,BSEE利用概率方法估算了29个固定平台(FP)的退役成本。据报告,总清除成本为 1.49 亿美元,即 510 万美元/FP。

所有建筑物均位于水深 <200 m 范围内,每个建筑物的拆除成本估计低于 800 万美元。大约一半的建筑被归类为主要和载人建筑。

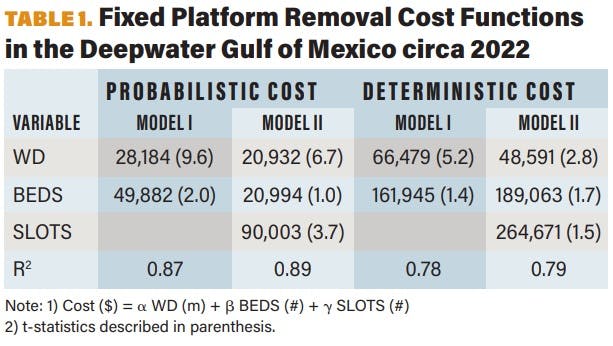

将 FP 去除成本与水深相关联可以为这些概率估计提供可靠的对应关系:

FP 成本(概率)= 32,402 WD

其中 FP 去除成本以美元为单位报告,水深 WD 以米为单位。模型拟合 R2 = 0.89。概率估计代表中值 (P50)。

概率一变量估计的成本函数是稳健且显着的。使用床数和/或井槽作为结构复杂性和/或尺寸的代理的回归模型在因素之间划分成本,但不会以其他方式改善模型拟合。

请注意,随着新属性添加到模型中,水深系数会下降[从 32,402/m 到 28,184/m(一个属性)再到 20,932/m(两个属性)],因为元素作为正变量输入。

所描述的成本函数预计能够以合理的准确度代表运营商报告的成本数据;成本函数也有望反映 BSEE 使用的成本估计算法。

固定平台:确定性成本估算

墨西哥湾深水区有 34 个 FP 和 2 个合规塔 (CT),进行了确定性估算,报告总成本为 8.43 亿美元,即每个 FP 2140 万美元,每个 CT 5900 万美元。

大多数平台位于水深 200-500 m 之间,退役成本从 1000 万美元到 8000 万美元不等(图 1)。

当操作员报告的成本数据不足以执行可靠的统计评估时,将执行确定性成本。在这种情况下,应用工作分解方法或简单的平均/中值成本估算。

工作分解方法是一种正式的假设方法,通过将操作分解为多个任务,然后估计每个任务的时间和成本来得出估计值。

工作分解方法类似于工程师对钻井和相关项目开发成本进行的 AFE(支出授权)估算,并且是行业中的标准和公认方法,但在对大量且多样化的资产集合执行时,需要特别注意提供可靠的评估。

由于其特殊性质(出于下述原因),从样本中排除三个数据点,水深对应关系产生稳健的关系,其斜率系数大约比概率关系大两倍半:

FP 成本(确定性)= 85,141 WD,

其中 FP 去除成本以美元为单位报告,水深 WD 以米为单位报告。模型拟合 R2 = 0.80。

同样,由于床层数和井槽是正变量,如果在模型中使用这些属性,则水深单位成本必然会随着每个新属性的增加而降低[从 85,141 美元/米到 66,479 美元/米(一个属性)到 48,591 美元/米(两个属性)]。

评估中排除了三个单独清除成本 > 1 亿美元的平台:Bullwinkle (23552),位于 429 m 的 GC65,Taylor Energy 的 MC20 平台 (23051),位于 169 m,以及 McMoRan 的 EW947 平台 (23925),位于 253米水深。

由于特殊情况,这些结构的运营商可能会获得第三方退役成本估算或进行自己的详细工程研究。Bullwinkle 是世界上最大的固定平台,预计结构拆除成本为 4.34 亿美元,而 MC20 平台和 EW947 平台均被飓风摧毁(目前位于海底),预计退役成本各为 1.25 亿美元。

对于MC20平台,自2008年平台倒塌以来,已有一口或多口井发生泄漏。2020年,花费了4200万美元在现场安装了收集泄漏石油的装置。至少有十几口井仍需要堵塞,而被击倒的结构的最终命运尚不清楚,因为其中大部分被埋在泥土下,并且可能根本无法在没有重大危险的情况下进行提升/移除。2021 年,泰勒能源公司在没收 4.75 亿美元的退役债券后自行解散。

墨西哥湾的两座合规塔 Baldpate (33039, 503 m) 和 Petronius (70012, 535 m) 的退役成本估计分别为 5500 万美元和 6200 万美元。使用这两个数据点,可以得到类似于 FP 成本公式的水深函数,但单位成本更大:

CT 成本 = 113,000 WD

其中 CT 去除成本以美元为单位,水深 WD 以米为单位。

2020年,埃克森美孚退役了位于305 m水深的合规塔Lena。使用上述成本函数,Lena 的退役成本估计约为 3400 万美元。莉娜号被推倒在地,运营商向路易斯安那州人工鱼礁计划捐赠了 1,070 万美元,这是完全拆除后预计节省的一半。如果 BSEE 的评估中不包括运营商的捐款,那么 Lena 完全拆除的实际成本将是 4500 万美元或 5600 万美元,具体取决于如何分配珊瑚礁节省的费用。

剩下的两座合规塔是否可行并得到政府允许,将决定未来的退役成本。

从确定性估计导出的成本函数提供了一种描述性方法,可以更好地理解 BSEE 程序并按结构类别比较单位成本。然而,与上面导出的概率固定平台(<200 m)成本函数不同,该函数被认为反映(或代理)BSEE成本估计模型,更深水域(>200 m)和浮动平台(将是第 4 部分中讨论的)不应被解释为 BSEE 成本模型的代理,因为 BSEE 在成本估算中并未采用此类模型。它们只是一种沿一个维度比较和描述成本估算的方法。

管道退役

所有 BSEE 管道退役成本估算均以确定性术语报告,这可能表明报告数据存在巨大差异。考虑到管道退役成本数据的稀疏性、运营的性质以及管道类型的多样性,这并不奇怪。

显然,每个管道段的单位成本约为 160 万美元,适用于散装石油、散装天然气、举升、脐带缆和水产品类别,每个管道段的单位成本约为 135 万美元,适用于石油和天然气产品类别。

所应用的单位成本可能由运营商成本数据的简单聚合平均值(或中值)确定。

报告的管道退役成本数据可能已使用工作分解算法进行了校准。

作者简介:Mark J. Kaiser 是路易斯安那州巴吞鲁日路易斯安那州立大学能源研究中心的教授。