Offshore staff

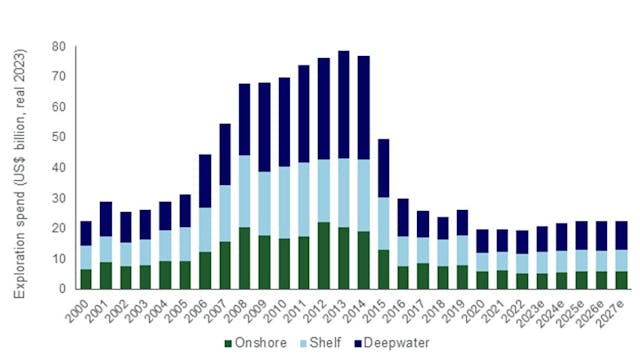

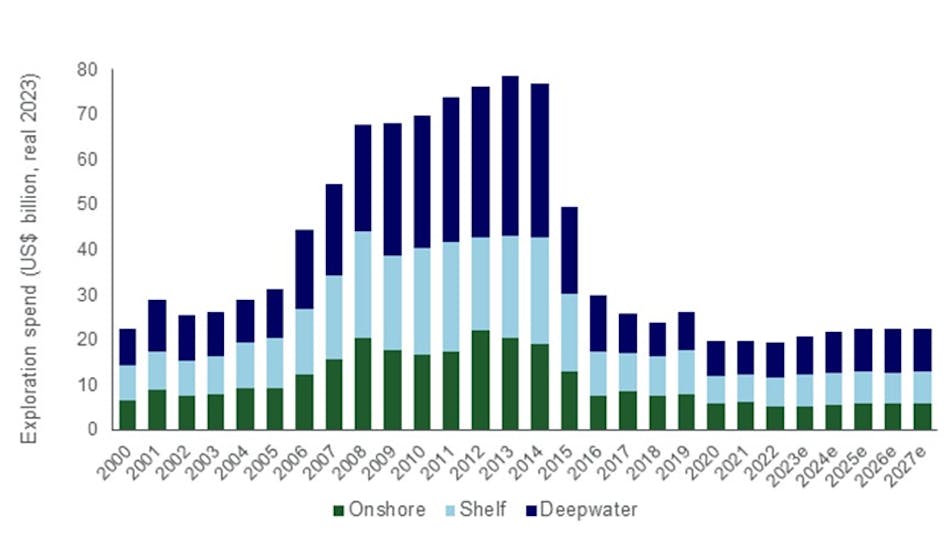

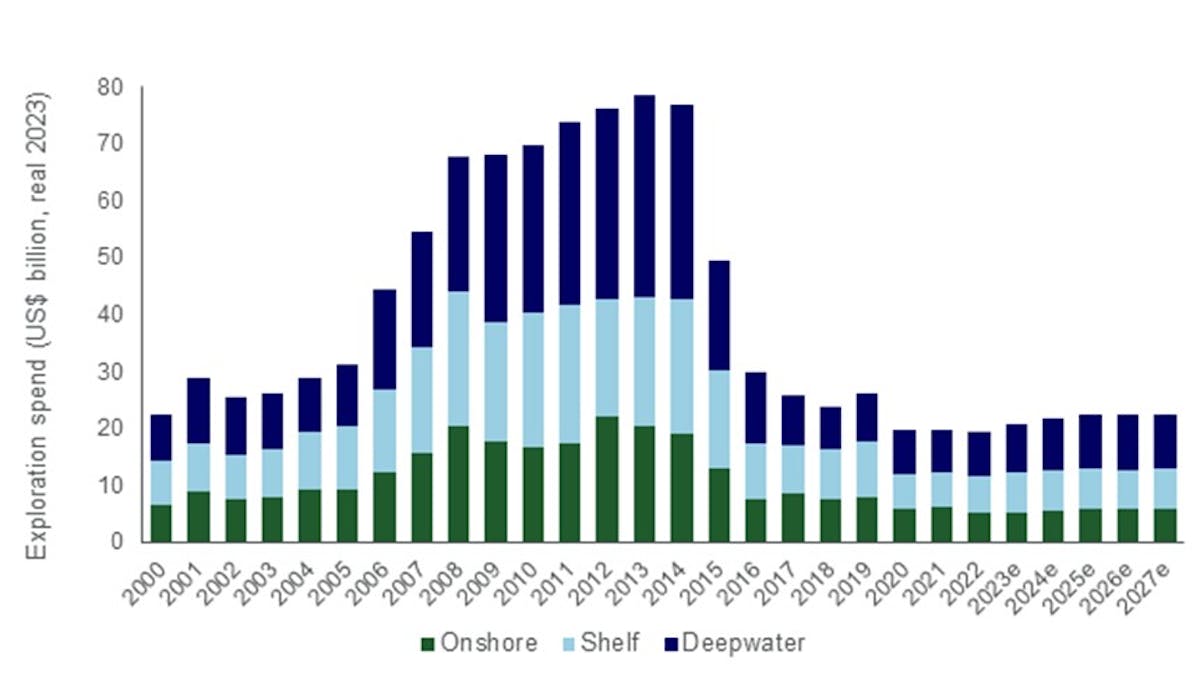

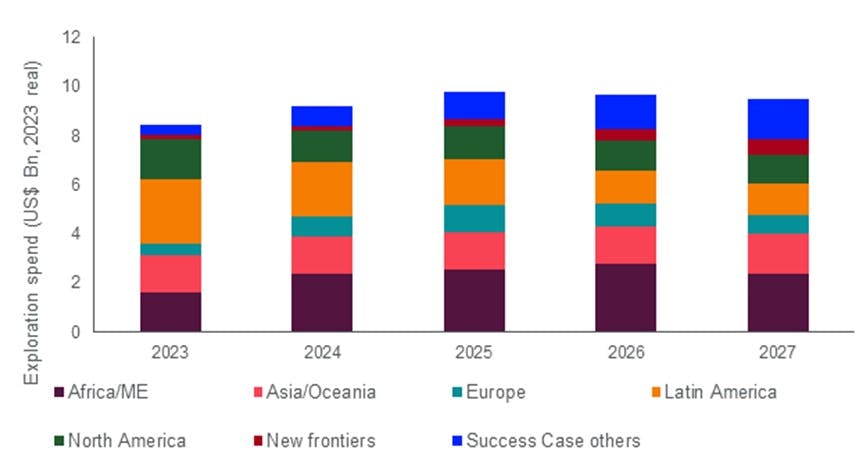

LONDON — Global spending on exploration, excluding appraisal, should average $22 billion per year in real terms over the next five years, according to Wood Mackenzie.

The consultants’ report says factors such as the need for energy security and the emergence of new frontiers will incentivize oil and gas companies to step up activity.

“Explorers will become bolder in the coming years,” said Julie Wilson, director of global exploration research. “Exploration went through a boom during 2006-2014 and spend peaked at $79 billion (in 2023 terms). But in the prior six years, the average was $27 billion per year in 2023 terms.

“While spending will increase, it won’t return to anywhere close to past highs, and there will likely be a ceiling on the increase. There is a lack of high-quality prospects that would satisfy today’s economic and ESG metrics, and a continued focus on capital discipline will keep a lid on overspending.”

The predicted growth starts this year, with spending set to rise by 6.8% over 2022 totals (in real terms), one driver being a strong business case. According to the consultants, full-cycle returns from exploration have been consistently above 10% since 2018 and topped 20% last year.

“These positive results have increased confidence in exploration,” Wilson said. “Portfolio high-grading coupled with greater discipline in spending and prospect choice mean only the best prospects are drilled and waste is minimized. Efficiency gains also serve to enhance the returns from both development and exploration.”

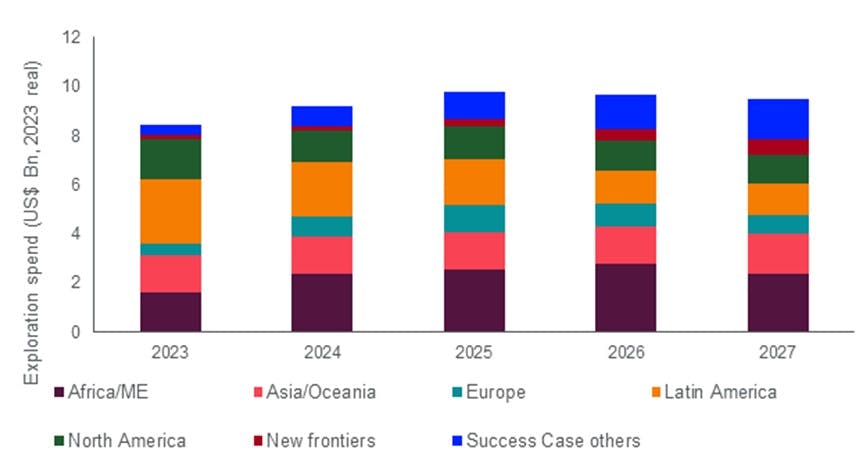

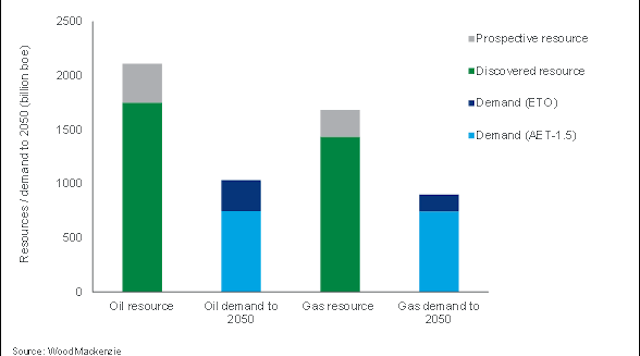

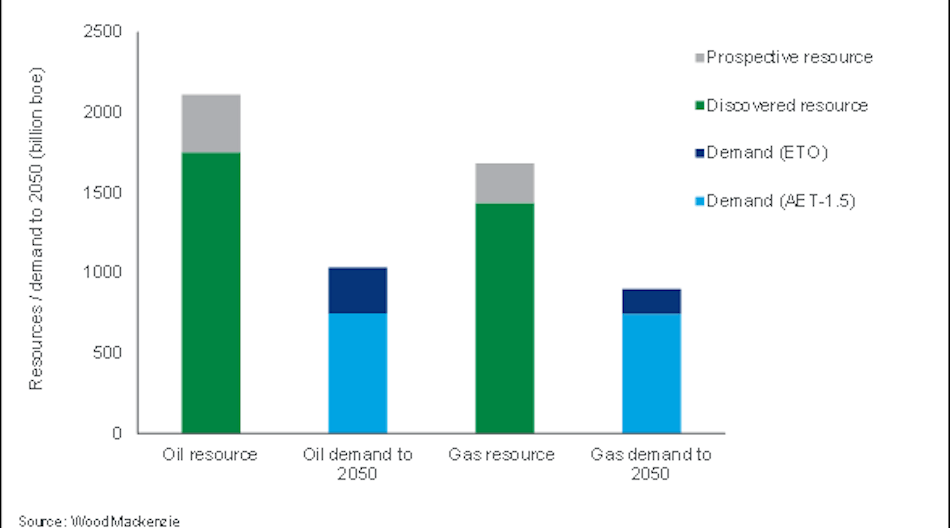

Deepwater and ultradeepwater look like providing the best exploration opportunities, particularly along West Africa’s Atlantic Margin of Africa and in the Eastern Mediterranean.

Elsewhere, companies are developing leads and prospects based on recently acquired seismic data, such as offshore Uruguay, southern Argentina and deepwater Malaysia, Wilson added.

“Future spend in ‘success case’ areas is additional exploration following success, whether that's in a frontier like Namibia or Greece, or a more established province like Egypt's Nile Delta,” she said.