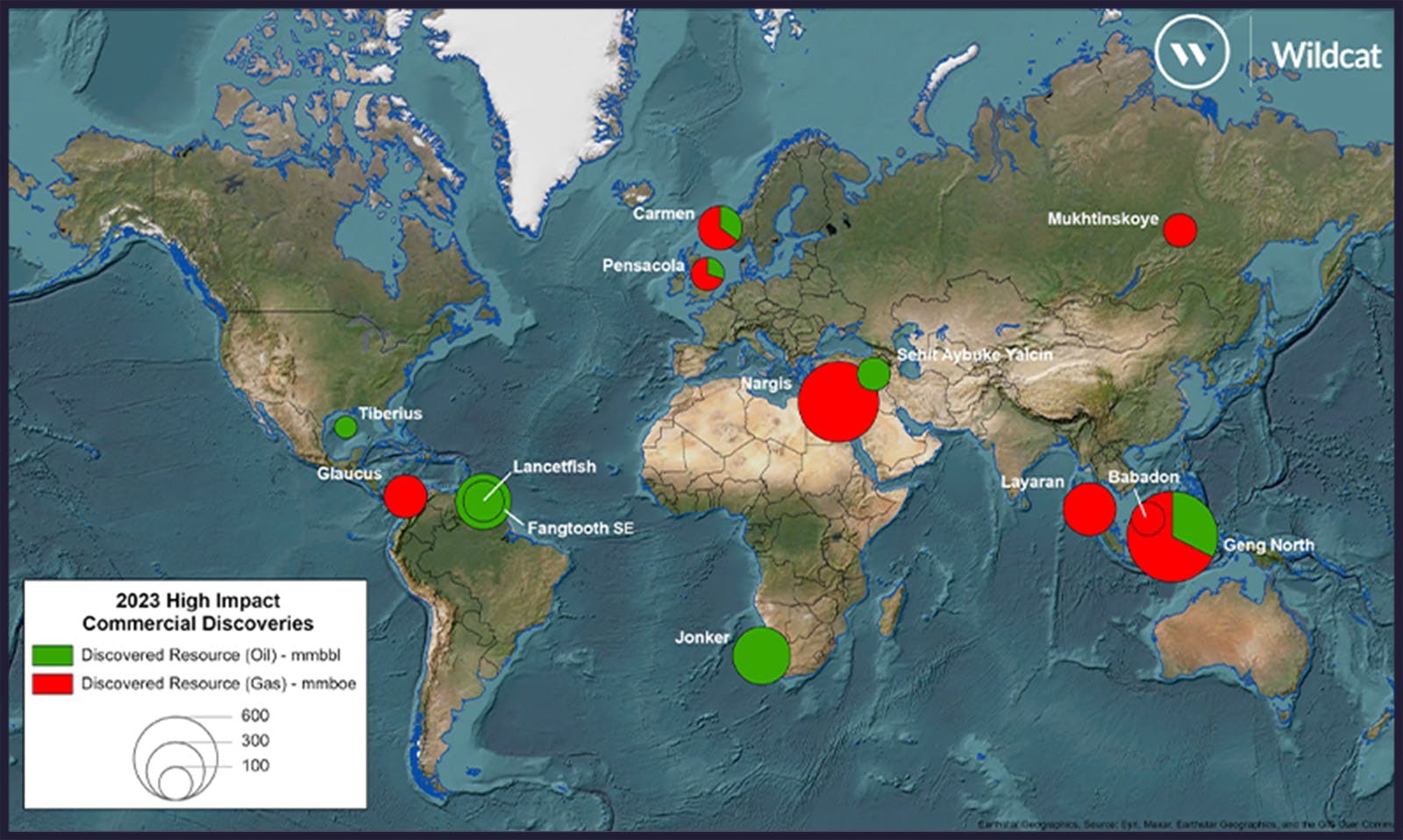

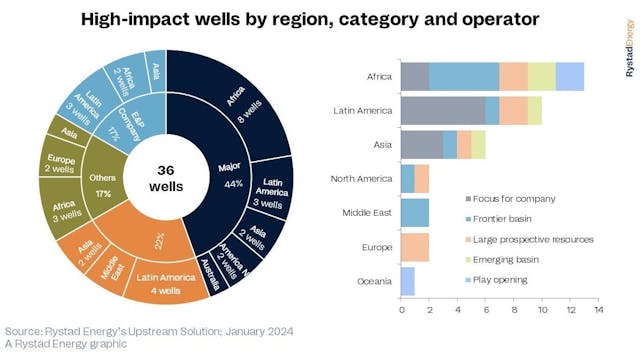

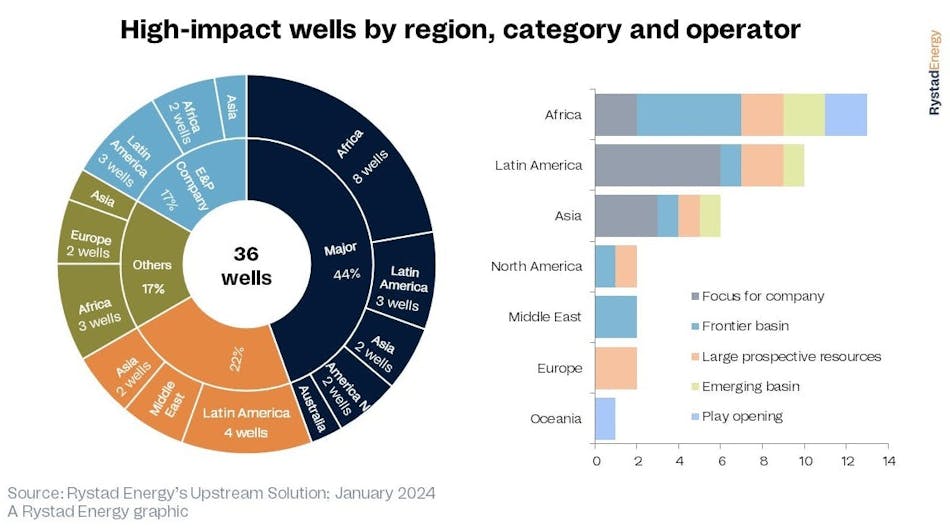

Wells to watch include planned frontier basin tests in Colombia and Argentina, while in Brazil the focus should be as before on the presalt Santos and Campos basins. Petronas and Petrobras will likely drill three commitment wells in the outboard presalt carbonate play. While in the inboard presalt, bp could drill its first operated well in Brazil since 2013.

Petrobras will also seek to test the deepwater potential of the Potiguar Basin on Brazil’s Equatorial Margin.

In Guyana, Exxon Mobil and its partners in the Stabroek Block will step up exploration of the gas-prone southeastern areas, Westwood’s consultants claim, but there could also be higher-risk wells outside of the core fairway.

Offshore neighboring Suriname, the Petronas-Exxon Mobil joint venture will likely drill more wells.

Offshore Mexico there could be fewer exploration wells this year as license round commitments are fulfilled. In the frontier Orphan Basin offshore Newfoundland and Labrador, the industry will be monitoring Exxon Mobil’s planned 2024 Persephone well.

Elsewhere, there should be notable frontier test wells in the Sabah Trough offshore Malaysia and more drilling on the emerging late Oligocene play in Indonesia’s North Sumatra Basin.

In northwest Europe, don’t expect too much high-impact drilling as operators in Norway in particular pin their hopes on infrastructure-led exploration (ILX) opportunities.

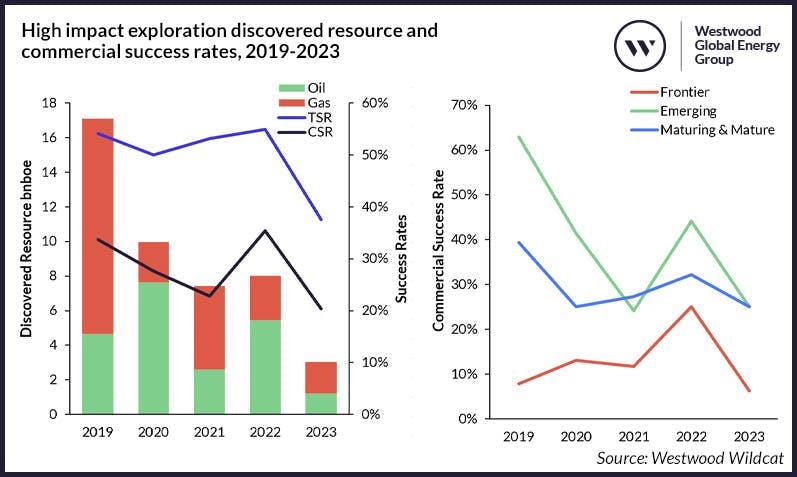

Last year’s 64 high-impact wells delivered 13 potentially commercial finds totaling ~1.2 Bbbl of liquids and ~11 Tcf of gas.