Rystad Energy and Wood Mackenzie recently released reports on what they consider to be the big forces shaping the upstream market this year, highlighting the potential for US supply growth and the trajectory of global oil and gas demand.

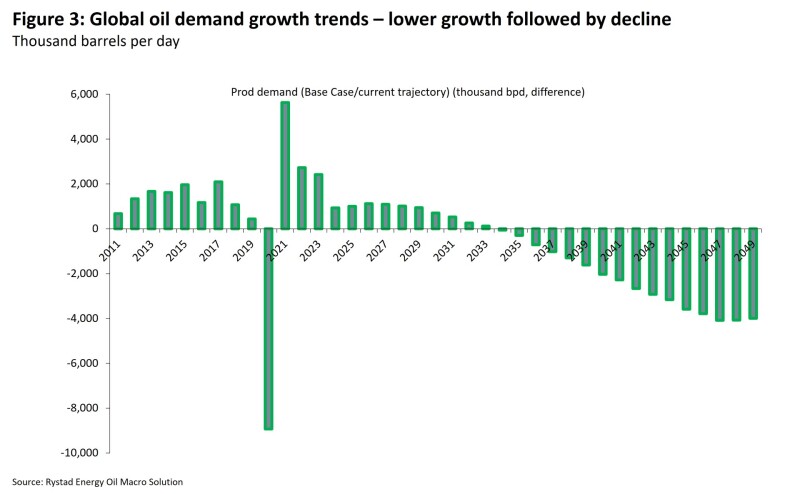

Due to varying factors such as the COVID-19 pandemic and the energy transition, there has been a structural shift in demand . This is according to a Rystad note that said these factors caused demand to fall 5 million B/D short of a scenario in which the pandemic had not happened.

OPEC+’s decisions on output targets along with industry underinvestment worked to help soften the imbalance between supply and demand, the firm added.

Rystad projects that these supply corrections will be sustained throughout the decade until sometime in the mid-2030s. At that point, oil supply is expected to overcorrect while global demand peaks at around 109 million B/D in 2035.

Rystad said the resulting imbalance of higher supply than demand could play out differently across regions. For instance, "Asia and Europe will continue to be the big shorts (deficit) for oil markets, while the Middle East and North America will continue to be long (surplus) and sources of imports.”

Impact of Trump 2.0

Among the biggest factors at play are the US oil industry’s response to US President-elect Donald Trump who moves back into the White House on 20 January.

“In a scenario where Trump 2.0 drives growth beyond the 1 million B/D mark, the price impact would certainly provide a check on the non-US, non-OPEC growth as less than 10% of the growth will come from producing wells,” Rystad said in its market update.

If this were to happen, Rystad foresees the possibility of OPEC+ taking steps to protect its market share by easing production cuts, potentially driving prices down by $20/bbl.

“The question is whether or not this is the strategy OPEC+ will pursue or will really want to take,” said Rystad.

Balancing the Market

Rystad also described this year as a potential “tipping point” as the industry absorbs a shift from a typical supply-demand imbalance of +1.5 million B/D to -1.5 million B/D to a supply overhang of about 2.5 million B/D.

The Norwegian market research firm said such a situation would be “unfeasible” and that industry investment cycles and geopolitical events would help bring balance to the market.

There is one big factor that analysts are not counting on to help: “The path of increasing demand has the lowest probability, as all scenarios ahead project a decrease in demand growth followed by an eventual decline.”

Not So Fast

WoodMac is projecting a slower energy transition and said in its recent note that the mood is improving in the upstream industry despite rising geopolitical risks and growing concerns over supply and demand.

“Increasing confidence in a higher-for-longer demand outlook for oil and gas is forcing upstream companies to revisit portfolio longevity. Sentiment towards upstream investment will continue to improve, tempered only by near-term macro headwinds. Investors will pay more attention to reserves and resource lives than in the last decade, and companies will look to reload their hoppers,” WoodMac said in its December report.

Merger and aquisiton activity also looks to be higher on strategic agendas. Operators will continue to venture into non-Permian basins, with more consolidation in the Eagle Ford and Bakken shales, as well as more movement in niche regions such as the Utica and Uinta basins.

Longer Permian Wells, Latin America, and Saudi Shale Gas

WoodMac also highlighted the importance of 3-mile lateral wells, as their recovery nearly matches that of 2-mile laterals. As more 3-mile laterals are drilled, the UK-headquartered firm said this will translate to lower unit costs, which in turn result in lower Capex for more tight-oil production.

Production from wells in the Americas is expected to increase by roughly 1 million B/D this year, maintaining the same growth level as in 2024, according to WoodMac.

The US Gulf of Mexico is expected to have a standout year as the Shenandoah, Whale, Anchor, and Ballymore projects are set to reverse basin declines seen last year, said WoodMac.

Latin America will also add significant volumes thanks to Brazil’s deepwater Mero and Buzios projects and Guyana’s Yellowtail and Redtail projects, along with Argentina’s Vaca Muerta Shale, which is on a path to reach 1 million B/D in tight-oil production.

On the international front, Saudi Aramco and the Abu Dhabi National Oil Company are fast-tracking the buildout of their global gas businesses. WoodMac also noted that the Jafurah basin in Saudi Arabia will be considered one of the biggest tests of tight-reservoir performance in the Middle East. Potential future partners will be eagerly evaluating the unconventional gas project, looking for an opportunity to participate.