Dallas-based Energy Transfer is growing its oil pipeline network by more than 3,000 miles and adding about 2 million bbl of storage capacity with its purchase of Houston-based Lotus Midstream Operations.

The deal, announced on 27 March, is valued at $1.45 billion and will expand Energy Transfer's footprint in the Permian Basin. Energy Transfer currently owns and operates 120,000 miles of pipeline and associated infrastructure network spanning 41 states.

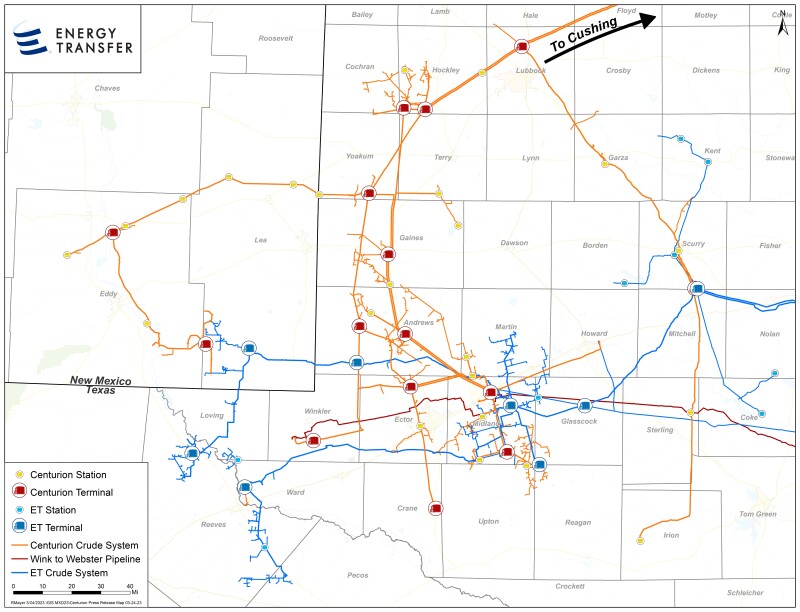

Lotus Midstream owns and operates Centurion Pipeline Co. which extends to southeast New Mexico, across west Texas to Cushing, Oklahoma. It covers the major production areas in the Permian Basin and has a capacity of about 1.5 million B/D. Additionally, its Midland Terminal offers 2 million bbl of crude oil storage capacity and additional supply and demand connectivity.

The acquisition also includes a 5% equity interest in the 650-mile-long Wink-to-Webster Pipeline system that transports more than 1 million B/D of crude oil and condensate from the Permian Basin to the Gulf Coast.

The cash and stock deal is expected to close by the end of the second quarter of 2023, pending regulatory approval.

Upon closing Energy Transfer said it expects to begin construction on a 30-mile pipeline project that will allow customers to originate barrels from its Midland terminals for ultimate delivery to Cushing. This project is expected to be completed in the first quarter of 2024.