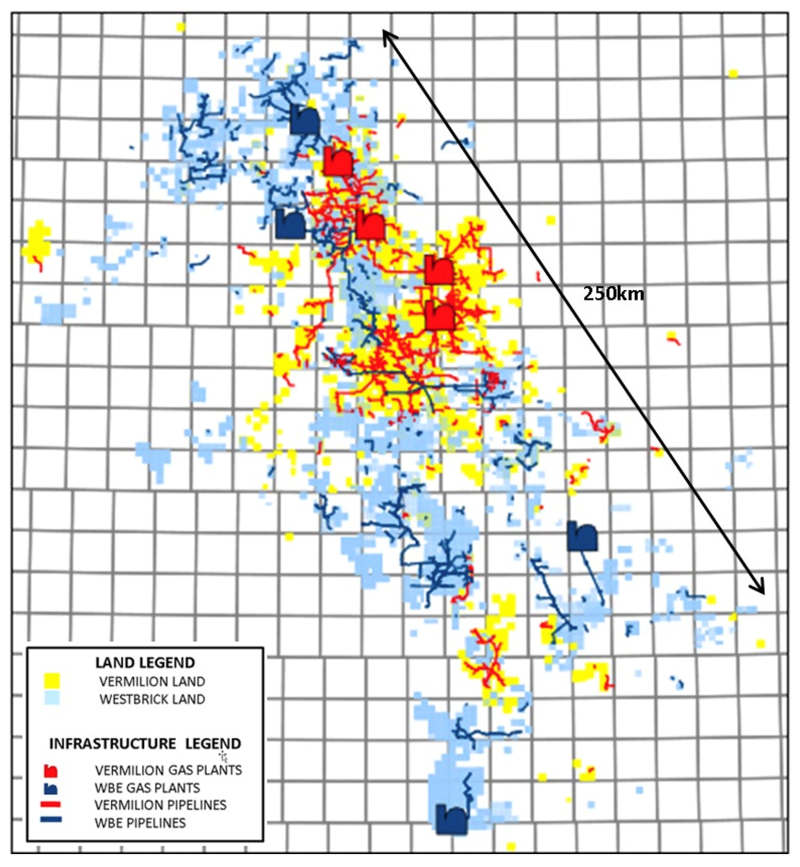

Canadian operator Vermilion Energy is expanding its footprint in Alberta’s Deep Basin through the acquisition of privately held Westbrick Energy for $745 million. The deal includes around 1.1 million (770,000 net) acres of land and four operated gas plants with total capacity of 102 MMcf/D in the southeast portion of the Deep Basin trend.

The footprint is contiguous and complementary to Vermilion's legacy Deep Basin assets providing significant operational and financial synergies, including capital efficiency improvements, infrastructure optimization, and gas marketing opportunities.

The acquisition excludes undeveloped Duvernay rights on approximately 300,000 (290,000 net) acres of land, which will be retained by the shareholders of Westbrick. Vermillion expects the deal to close in the first quarter of 2025.

“The Deep Basin is an area Vermilion has been operating in for nearly three decades and is currently the largest producing asset in the company,” said Dion Hatcher, president and CEO of Vermilion. “The acquisition adds 50,000 BOE/D of stable production and approximately 1.1 million (770,000 net) acres of land from which Vermilion has identified over 700 drilling locations, providing a robust inventory to keep production flat for over 15 years while generating significant free cash flow to enhance the company’s long-term return of capital framework.”

With the additional Deep Basin production from the acquisition, Vermillion becomes the fifth-largest Deep Basin producer.

Upon closing, Vermilion will be an approximately 135,000 BOE/D entity with greater than 80% of its production derived from its global gas franchise, consisting of approximately 550 MMcfe/D of liquids-rich gas in Alberta and British Columbia and more than 100 MMcf/D of European gas with direct exposure to LNG pricing, resulting in premium realized gas prices.

Vermillion expects annual production of 50,000 BOE/D (75% gas and 25% liquids) during 2025, based on the operator’s development plans. This production level represents 5% year-over-year growth and is forecast to generate more than $110 million of annual free cash flow based on forward commodity prices.

The 700 locations added to the drilling inventory are primarily located in the Ellerslie, Notikewin, Rock Creek, Falher, Cardium, Wilrich and Niton formations, with half-cycle internal rate of returns ranging from 40% to over 100% based on estimates provided by an independent consultant.

Proved developed producing and proved plus probable reserves are estimated at 92 million BOE (75% gas) and 256 million BOE (74% gas), respectively.