雷斯塔能源称,东南亚新的海上天然气项目计划中的最终投资决定可能带来 1000 亿美元的投资。

主要驱动因素包括深水开发、最近在印度尼西亚和马来西亚近海的成功发现以及碳捕获和储存(CCS)的进步。

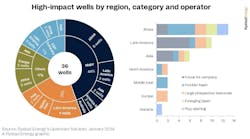

到 2028 年,石油和天然气巨头可能将占计划投资的 25%,而国家石油公司 (NOC) 则将占计划投资的 31% 左右。

东亚上游公司应占 15% 的份额,通过并购和即将开展的勘探项目具有增长潜力。根据道达尔能源最近在马来西亚进行的上游收购,这些大公司的份额可能进一步增强至 27%。

然而,Rystad 警告称,该地区项目的持续推迟仍然令人担忧。这是深水和酸性天然气经济、基础设施准备情况和地区政治等因素共同造成的。其中一些问题已经存在了 20 多年。

但马来西亚和印度尼西亚 CCS 中心的出现可能会改变这种僵局。一些计划中的海上项目中二氧化碳含量较高,因此需要 CCS 来获得融资和遵守法规。

两国还在评估将成熟油田的枯竭油藏转变为二氧化碳储存场所。

Rystad Energy上游研究副总裁Prateek Pandey表示,“我们认识到该地区新项目投资和资本承诺的潜力,这一数字从2022-2023年的95亿美元飙升至2024-25年的约300亿美元。

“随着我们对数据的深入研究,越来越明显的是,这种上升趋势预计将持续到 2028 年。最近的发现和国家石油公司的参与将在这一增长中发挥至关重要的作用,特别是在深水开发方面,这对于确定这一预期的 1000 亿美元繁荣中可以实现多少至关重要。”

在印度尼西亚,最突出的潜在天然气项目包括Inpex 运营的阿巴迪液化天然气 (Abadi LNG)、埃尼公司的印度尼西亚深水开发项目和英国石油公司的 Tangguh Ubadari 碳捕获项目。

Rystad 表示,这些发现加上最近在东加里曼丹和安达曼地区发现的油气田,将占印尼 FID 确定的海上天然气总投资的 75%。

马来西亚即将进行的 FID 项目应包括自 2020 年以来发现的油气资源,主要由马来西亚国家石油公司、PTTEP 和壳牌负责监管。据说,在整个东南亚,超过一半的计划中的天然气项目中二氧化碳含量超过 5%,深水项目趋向于集群开发。

Rystad 补充道,预计到 2028 年,最终投资决定中的天然气资源量可能达到 58 万亿立方英尺。但存在经济挑战,特别是在深水和酸性天然气开发方面。许多项目可能需要天然气价格高于历史平均水平 4 美元/万亿立方英尺才能盈利,最佳门槛接近 6 美元/万亿立方英尺。

供应链公司可以从浮式项目和深水钻井中获益。