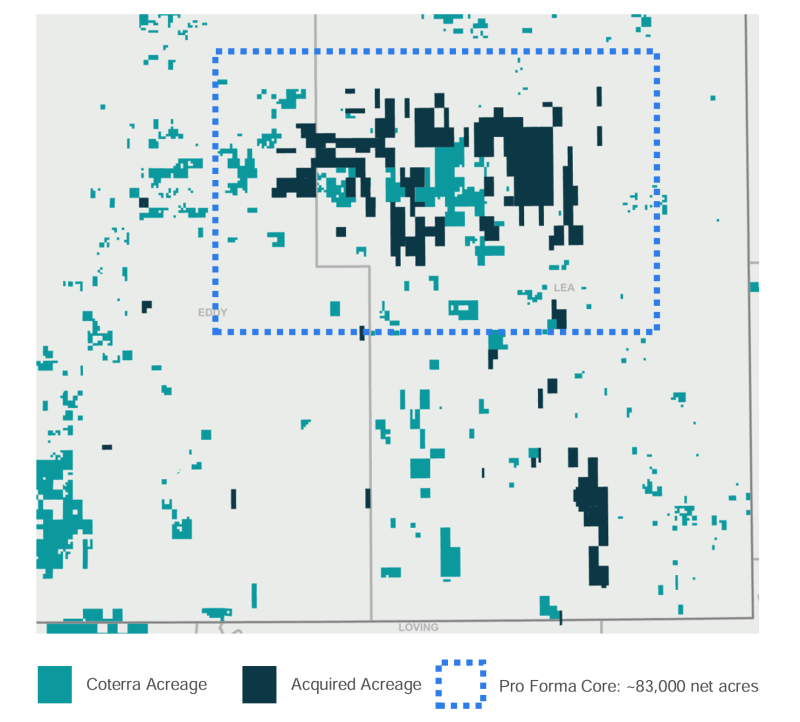

Coterra Energy will spend $3.95 billion in cash and stock to acquire certain Permian Basin assets of Franklin Mountain Energy and Avant Natural Resources and its affiliates. The assets add an oil-weighted focus area in New Mexico and are situated mainly in the northern Delaware Basin with approximately 49,000 net highly contiguous acres concentrated in Lea County, creating a new 83,000-net-acre focus area within the Coterra portfolio.

The new assets also include 400 to 550 net Permian locations, primarily targeting Bone Spring, Harkey, Avalon and the emerging oily Lower Wolfcamp/Penn Shale.

“We are thrilled to announce the pending acquisition of two high-quality Permian Basin asset packages,” said Tom Jorden, chairman, CEO, and president of Coterra. “These highly accretive acquisitions create an expanded core area in New Mexico that plays to Coterra’s organizational strengths. In addition to adding significant oil volumes in 2025, the acquired assets provide inventory upside to established and emerging oil-weighted formations.”

The deals will see Coterra spending $2.95 billion in cash and $1.0 billion in Coterra common stock. The cash portion of the consideration is expected to be funded through a combination of cash on hand and borrowings.

“We have been drilling horizontal wells in Lea County, New Mexico, since 2010 and are extremely excited with the recent results and future opportunity across the area,” added Jorden. “The newly scaled platform provides a long runway for capital-efficient development and substantial free cash flow generation. Importantly, we are maintaining an industry-leading balance sheet.”

The acquired acreage is about 85% operated. Also included in the deals are approximately 125 miles of pipeline and other infrastructure, which are expected to enhance netbacks and economics across existing acreage and the new focus area.

Coterra estimates 2025 capital expenditures of $400 million to $500 million, 2025 oil production of 40,000 to 50,000 BOPD, and total equivalent production of 60,000 to 70,000 BOED for the Franklin Mountain and Avant Natural Resources assets.

“These companies are two of the top remaining private company acquisition targets left in an increasingly consolidated Permian Basin and potentially one of the last chances in this consolidation cycle for Coterra to materially increase its Delaware footprint outside of public company corporate M&A,” said Andrew Dittmar, principal analyst at Enverus Intelligence Research. “By combining these two companies into concurrently announced deals, Coterra was able to maintain its inventory duration in the Delaware, keep quality consistent, and improve its free cash flow profile.”

The transactions are each subject to satisfaction of customary terms and conditions and are expected to close during the first quarter of 2025, with effective dates of 1 October 2024. Neither acquisition is conditioned on the closing of the other acquisition.

Coterra was formed in late 2021 through the merger of Cabot Oil & Gas and Cimarex Energy.