Offshore staff

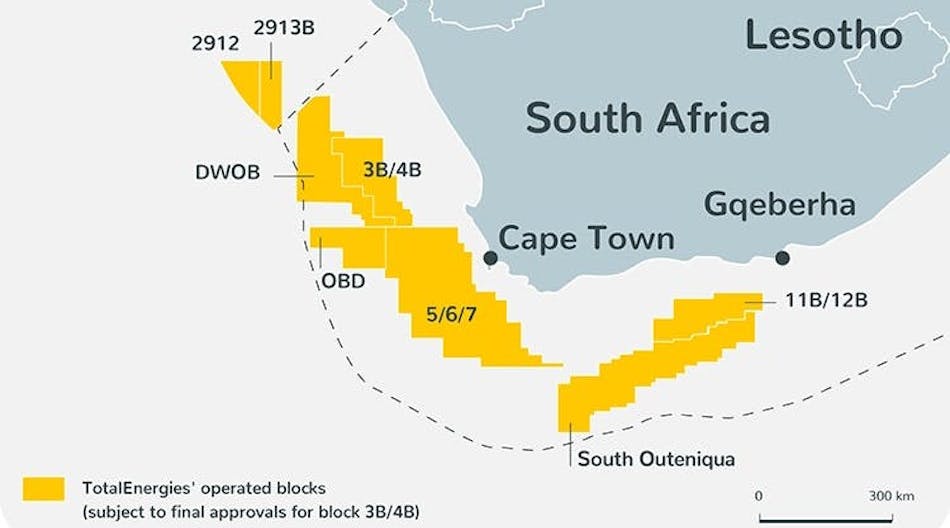

ABERDEEN – As the global oil and gas industry pivots towards floating production systems, Energy Maritime Associates (EMA) has released a new report forecasting robust demand, with projected orders reaching up to $173 billion for as many as 168 units within the next five years.

The market is predominantly driven by floating production storage and offloading vessels (FPSOs), floating liquefied natural gas (FLNG) units, and production semisubmersibles. However, this surge in demand comes with its own set of challenges, the report says.

EMA says that its “Floating Production Outlook Report (2024-2028)” offers a thorough analysis of the market but also warns of potential supply chain bottlenecks. With shipyard slots for FPSO hulls and other integral orders nearly fully booked through to 2026, the industry could face significant project timing and cost implications as constructors scramble for alternative suppliers.

Despite these challenges, the report shines a light on strong project economics buoyed by high hydrocarbon prices, low project break-evens, and the comparatively low carbon footprint per barrel of these systems.

“Our in-depth report does not just chart out the demand but provides a clear-eyed view of the potential hurdles ahead,” says David Boggs, Managing Director of EMA. “It’s crafted to arm industry executives with actionable intelligence, balancing the excitement of a booming market with the realities of supply constraints.”

11.08.2023